Have you ever wondered how a small investment today can blossom into a substantial sum in the future? Or maybe you’ve been tempted by a quick loan offer that seems too good to be true. The concept of the time value of money explains precisely why these scenarios play out the way they do. It’s about recognizing that money today is worth more than the same amount of money tomorrow, simply because of the potential earning power of that money over time. Think of it like this: if you were offered a choice between receiving $100 today or $100 a year from now, which would you choose? Most people would choose the money today because they could invest it and potentially earn more than just the $100. This is the core principle of the time value of money.

Image: www.coursehero.com

The time value of money isn’t just a theoretical concept; it’s a fundamental principle that guides countless financial decisions, ranging from personal savings and investments to complex business projects. It’s a tool that helps us make informed choices about how to allocate our resources and maximize our financial returns. So, let’s dive deeper into this fascinating concept and explore some concrete examples that illustrate its practical applications.

Time Value of Money Explained

The time value of money (TVM) is a core financial principle that states money available at the present time is worth more than the same amount in the future, due to its potential earning capacity. This principle recognizes that money can be invested and grow over time, earning interest or profits. Think of it as a magical money tree. If you plant $100 today, it can grow and potentially bear more fruit (interest or dividends) in the future. This explains why $100 today is considered “more valuable” than $100 in a year. The longer you wait, the less valuable the same amount of money becomes because you lose the opportunity to earn interest on it during that period. This difference in value is what we call the “time value of money.”

Let’s delve a little deeper into the factors that contribute to the time value of money. There are two main factors that drive the time value of money:

Key Factors Driving the Time Value of Money

- Interest Rates: Interest rates are like the price you pay (or receive) for lending (or borrowing) money. When you lend money, you expect to be compensated for the opportunity cost of not using that money yourself. Similarly, when you borrow money, you are essentially paying for the use of that money. The higher the interest rate, the faster your money grows, making it even more valuable today.

- Inflation: Inflation is the general increase in the prices of goods and services over time. When prices go up, the purchasing power of your money diminishes. This means that the same amount of money will buy you less than it did in the past. To compensate for inflation, investors demand a return that at least covers the expected rate of inflation. This makes money today even more attractive than the same amount in the future.

TVM: How it Impacts Your Decisions

Now that we understand the basic idea, let’s see how this concept plays out in real-world scenarios:

Image: www.chegg.com

1. Saving for Retirement

Imagine you’re planning for retirement in 30 years. The sooner you start saving, the more time your money has to grow through compound interest. This is why it’s so important to start saving early, even if it’s just a small amount. The power of compound interest works wonders over time, turning your initial investment into a much larger sum. This is a classic example of the time value of money at work, turning small investments into substantial returns over long periods.

2. Taking Out a Loan

When you borrow money, you pay interest for the privilege of using that money now. The longer the loan term, the more interest you accrue over time. This is why it’s crucial to understand the total cost of borrowing and compare different loan options carefully. The time value of money emphasizes the importance of paying off high-interest debts quickly. The longer you hold onto debt, the more you are “paying back the future” at a high cost, diminishing the present value of your money.

3. Investing in Stocks or Bonds

When you invest in stocks or bonds, you are essentially lending money to a company or government in exchange for future returns. The time value of money dictates that the longer you hold an investment, the greater the potential for your investment to grow. This is the magic of compounding! However, it’s also crucial to consider the risk associated with different investments. The higher the risk, the greater the potential return, but also greater the chance of losing your investment. This is where the time value of money comes in, factoring in both the potential return and the risk associated with your investment choices.

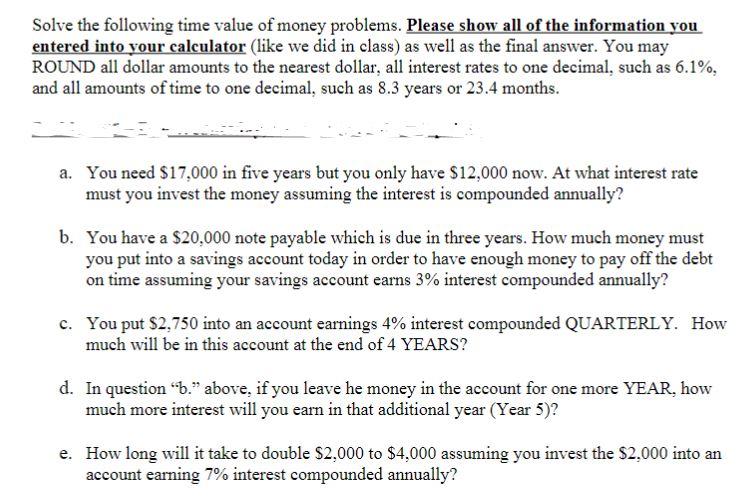

Time Value of Money Sample Problems: Understanding the Math

Let’s now dive into some concrete examples to illustrate how the time value of money works. These examples will help you grasp the practical application of the concepts we discussed.

Example 1: Future Value with Compound Interest

Let’s say you invest $1,000 today at an annual interest rate of 5% for 10 years. How much will your investment be worth at the end of 10 years? To calculate the future value, we use the formula:

FV = PV x (1 + i)^n

FV = Future value; PV = Present value; i = Interest rate per period; n = Number of periods.

Plugging in the numbers we get:

FV = $1,000 x (1 + 0.05)^10

FV = $1,000 x (1.05)^10

FV = $1,000 x 1.62889

FV = $1,628.89

So, your initial investment of $1,000 will grow to $1,628.89 after 10 years, thanks to the power of compounding. This example illustrates how the time value of money works in favor of long-term investors. The longer you leave your money invested, the more it will grow due to compound interest. Remember, patience is key!

Example 2: Present Value with Discounting

Now, let’s consider the opposite scenario. Imagine you’re promised $10,000 in five years. Assuming a discount rate of 8%, what is the present value of that future payment? The present value (PV) is the current worth of a future sum of money, considering the time value of money. In this case, the discount rate represents the return you could earn by investing the money today. The present value can be calculated using the formula:

PV = FV / (1 + i)^n

PV = Present value; FV = Future value; i = Discount rate; n = Number of periods.

Plugging in the numbers we get:

PV = $10,000 / (1 + 0.08)^5

PV = $10,000 / (1.08)^5

PV = $10,000 / 1.46933

PV = $6,805.83

This means that receiving $10,000 in five years is equivalent to receiving $6,805.83 today, given an 8% discount rate. This calculation helps you understand that receiving a larger sum in the future is not necessarily the most desirable outcome. It’s important to consider the opportunity cost of waiting and the present value of future cash flows.

Tips and Expert Advice

So, how can we leverage the time value of money to our advantage?

Here’s some expert advice for maximizing the return on your investments and managing your finances wisely:

- Start saving early: The earlier you start saving, the more time your money has to grow and compound. This holds true for retirement savings, college funds, or any other financial goal. Even a small amount saved consistently over a long period can yield substantial results.

- Invest wisely: Look for investments that offer a reasonable return on your investment, considering the associated risks. Diversify your portfolio to spread out risk, instead of putting all your eggs in one basket.

- Pay off high-interest debt: Prioritize paying off high-interest debt, such as credit card debt, to avoid losing a significant portion of your hard-earned money to interest charges.

- Understand the opportunity cost: Whenever you decide to spend money, consider the opportunity cost of that decision. For example, if you spend money on a new gadget, are you sacrificing the opportunity to invest that money and earn a return?

- Plan for the future: Plan for future expenses, such as retirement, healthcare, or education, so that you can accumulate the necessary funds over time. It’s easier to manage your finances and achieve your financial goals when you have a roadmap.

FAQ

Here are answers to some frequently asked questions about the time value of money:

Q1: How can I calculate the time value of money (TVM) myself?

You can use online calculators or spreadsheet software to calculate the time value of money. These tools often require you to input the following information:

– Present value (PV)

– Future value (FV)

– Interest rate (i)

– Number of periods (n)

Q2: Is the time value of money always relevant?

Yes, the time value of money is a fundamental principle that applies to all financial decisions. Whether you’re saving, investing, borrowing, or spending, the time value of money should be considered.

Q3: How does inflation affect the time value of money?

Inflation erodes the purchasing power of money over time. This means a certain amount of money can buy fewer goods and services in the future than it can today. To account for inflation, investors often adjust their expected return from investments to ensure they at least keep pace with inflation. In effect, the time value of money increases when inflation is factored in, making a dollar today even more valuable than that same dollar in the future.

Time Value Of Money Sample Problems

https://youtube.com/watch?v=U2aLh_IRiYo

Conclusion

The time value of money is a powerful concept that underscores the significance of patience, planning, and wise financial decisions. It helps us understand how money can grow over time, and how delaying gratification can lead to greater financial rewards. By mastering the time value of money, you empower yourself to make informed financial choices that benefit your present and future self.

Are you interested in learning more about the time value of money and its applications in different financial scenarios? Let me know in the comments below, and I’ll be happy to explore these topics further in future posts.