Have you ever considered the intricate network that powers your financial transactions? Every time you transfer money, pay a bill, or even use your debit card, a silent symphony of numbers orchestrates the smooth flow of funds. At the heart of this system lie the enigmatic Federal Reserve Bank routing numbers, a seemingly random sequence of digits that play a crucial role in the US financial infrastructure.

Image: www.magnifymoney.com

These nine-digit codes are more than just a series of numbers. They act as unique identifiers for each financial institution in the country, facilitating the seamless transfer of money between banks and financial organizations. Understanding the importance and nuances of Federal Reserve Bank routing numbers is essential for anyone involved in financial transactions, whether it’s personal banking, business operations, or even international trade.

Unveiling the Basics: What are Federal Reserve Bank Routing Numbers?

To fully appreciate the significance of Federal Reserve Bank routing numbers, we need to understand their foundational role within the US financial system. These numbers, also known as ABA routing numbers or RTN, serve as vital indicators for banks and institutions. Imagine a vast network of interconnected institutions across the nation, each with its unique identifier. These identifiers streamline the process of routing funds between these diverse institutions, making financial transactions efficient and accurate.

Each Federal Reserve Bank routing number consists of nine digits, with each digit holding a specific meaning. The first four digits identify the specific Federal Reserve district the financial institution operates in. The next four digits represent the American Bankers Association (ABA) transit number, specifying the particular bank or financial institution. Finally, the ninth digit acts as a check digit, ensuring the integrity and accuracy of the routing number. This elaborate system guarantees smooth and reliable transactions, ensuring the funds reach their intended recipient without encountering any errors.

The Power of the Network: How Federal Reserve Bank Routing Numbers Enable Financial Transactions

Consider the scenario of transferring funds from your bank account to another individual’s account. The transfer process relies heavily on the Federal Reserve Bank routing number. When you initiate a transaction, your bank retrieves the beneficiary’s routing number and their account number, sending this information along with the transaction amount to the Federal Reserve system. The Federal Reserve acts as a central clearinghouse, utilizing the routing numbers to accurately direct the money from your bank to the beneficiary’s bank. This system ensures efficient and secure movement of funds, streamlining the entire financial process.

Going Beyond the Basics: Why Understanding Federal Reserve Bank Routing Numbers Matters

Knowing about Federal Reserve Bank routing numbers goes beyond academic knowledge. It empowers you to make informed financial decisions and navigate the world of banking with confidence. Understanding these numbers can prove particularly helpful when:

- Making online payments: When making online payments or setting up automatic bill payments, ensure the routing number and account number are correct to avoid errors and delays.

- Receiving wire transfers: When receiving a wire transfer from another bank, having your bank’s routing number readily available is crucial for the efficient processing of the transaction.

- Managing business accounts: Business owners need to understand routing numbers to process payroll, make vendor payments, and manage other financial transactions.

- Reconciling bank statements: Routing numbers can help you identify and reconcile transactions on your bank statement. If a transaction involves multiple banks, the routing number can help you understand the origin and destination of the funds.

Image: www.tpsearchtool.com

Navigating the Labyrinth: Where to Find Federal Reserve Bank Routing Numbers

Obtaining the necessary Federal Reserve Bank routing numbers is a straightforward process. You can typically find this information on:

- Your bank’s website: Most banks provide a readily accessible section on their website dedicated to account information, including the routing number.

- Your bank statement: The routing number is often printed on your bank statement, usually in the top right or left corner.

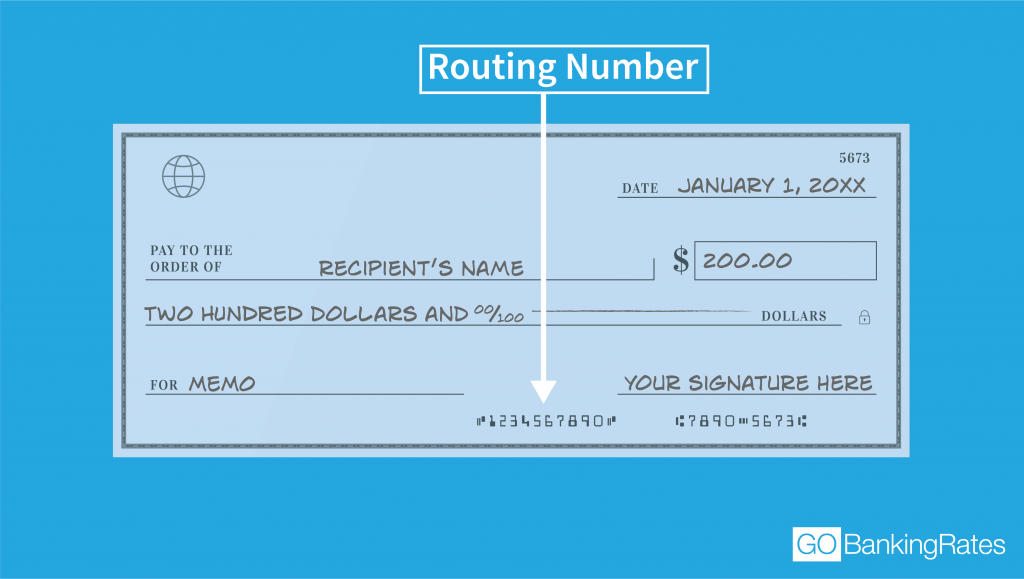

- Your checks: Checks printed by your bank will display the routing number on the bottom, usually in the left-hand corner.

- Your bank’s customer service: If you cannot locate the routing number through other means, you can contact your bank’s customer service department for assistance.

Exploring the Future: Trends and Evolution in Federal Reserve Bank Routing Numbers

The realm of financial technology is constantly evolving, and the usage of Federal Reserve Bank routing numbers is adapting to meet these challenges. The rise of mobile banking and digital payment platforms is leading to increased emphasis on secure and efficient transactions. As a result, the use of routing numbers is becoming increasingly integrated with these technological advancements.

Federal Reserve Bank Routing Numbers List

Final Thoughts: Embracing the Importance of Federal Reserve Bank Routing Numbers

Understanding the functionalities of Federal Reserve Bank routing numbers is essential in navigating the complex world of finance. These nine-digit codes play a fundamental role in connecting banks and financial institutions, ensuring a smooth and secure ecosystem for conducting financial transactions. As the financial landscape continues to evolve, being knowledgeable about routing numbers will only become more important, allowing you to manage your funds confidently, make informed financial decisions, and navigate a world increasingly reliant on digital transactions.

The next time you experience the seamless transfer of money, take a moment to appreciate the critical role played by these seemingly simple numbers. Remember, knowledge is power, and understanding Federal Reserve Bank routing numbers empowers you to navigate the financial world with greater confidence and clarity.